Glory Tips About How To Reduce Bank Charges

Life is busy and we all get caught up.

How to reduce bank charges. Hsbc holdings on wednesday reported a shock $3 billion charge on its stake in a chinese bank amid mounting bad loans in the country, sending the british bank's. Pay special attention to minimum balance requirements. Get a free business bank account.

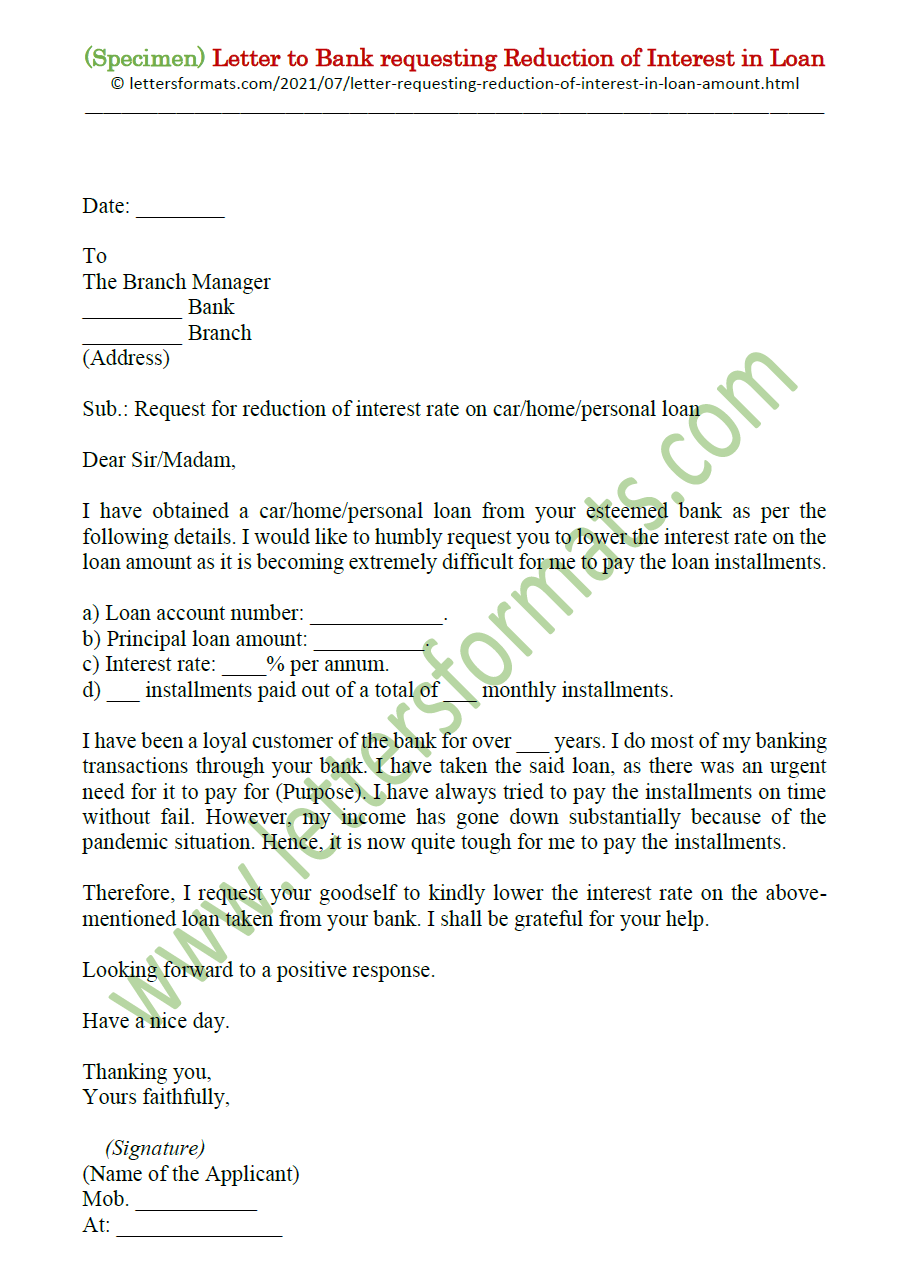

With this in mind, it makes sense to reduce bank fees wherever and whenever you can. 9 ways to reduce business bank charges to run a business, you generally need a bank account. The market is teeming with banks, so pick the one that suits your needs best.

Stop throwing your money away and keep more of it in your wallet with these 4 tips to avoid paying those annoying bank fees. If you’re looking to reduce overdraft fees, monthly maintenance charges or fees for withdrawing cash, there are ways to do so — and they don’t require finding a. Monthly fees can range from $4 to $25, but.

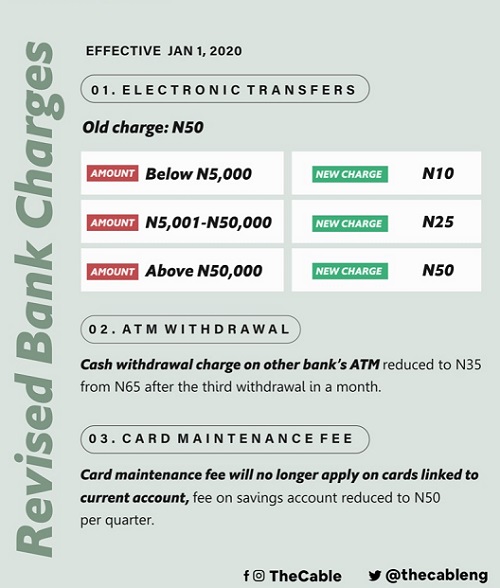

These are usually free or attract lower costs compared to using a bank branch. the convenience also saves time and money. Cash app doesn’t charge to send money that is processed within one to three business days, but instant payments have fees ranging between 0.5% and 1.75%. Monthly maintenance/service fee many banks charge by the month for you to keep your money in an account with them.

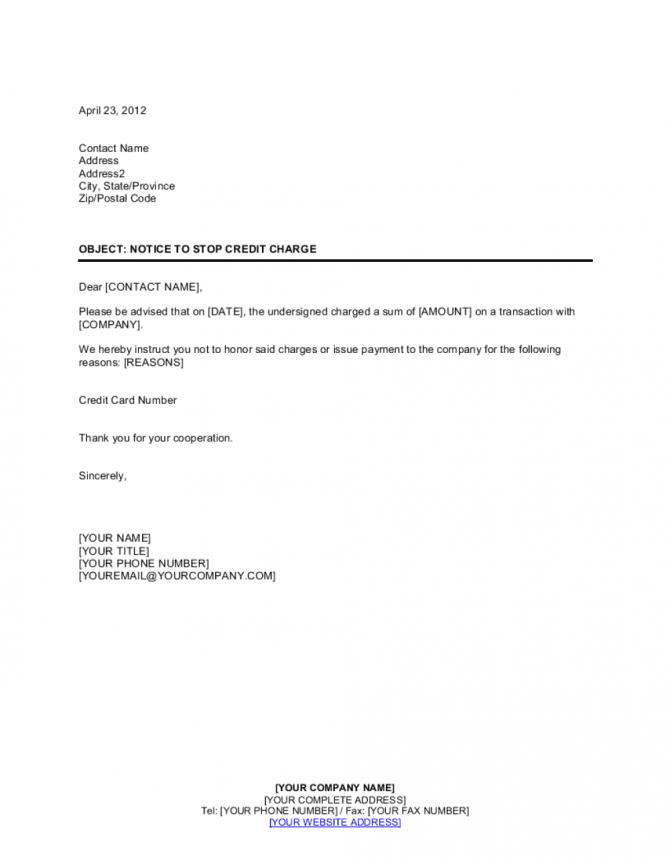

Updated / tuesday, 7 aug 2018 13:57. It isn't just planned expenses that impact budgets but also small expenses and hidden fees and charges that eat away at our bank accounts. For cardholders with “good” credit — a credit score of 620 to 719 — the typical interest rate charged by big banks was about 28 percent, compared with about 18.

Many us banks charge incoming wire fees which are deducted from a wire when it’s deposited into the recipient’s account. Top tips to avoid bank charges and fees always maintain the stipulated minimum balance in the account. Look into a credit union.

This guide aims to provide you with the knowledge and strategies needed to manage. As you limit the transactions you make through your bank account and switch to this platform, cost incurred from your business account charges will reduce. Furthermore, he says, ask for.

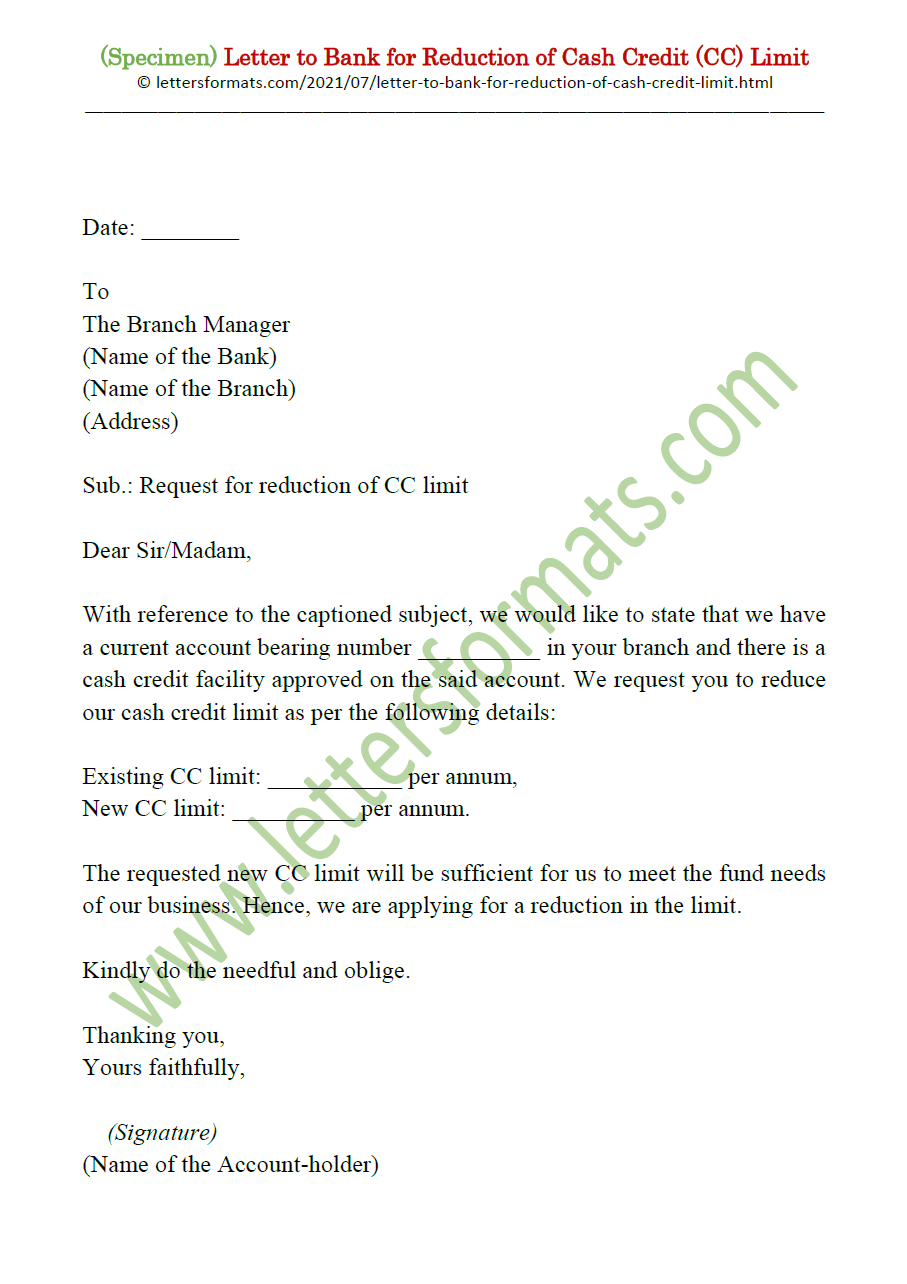

Here are a few simple ways to help you stay on top of bank charges and reduce the impact on your business. Negotiating bank fees: If you’re a long standing customer, they may give you a break — as.

Small changes in your banking habits can make a big dent in the fees you. Two strategies share upfront approach. Whittling down your current account fees the smart way.

Most banks levy monthly maintenance charges on your account, but many of them also have a policy of waiving these fees, too. However, that doesn’t mean you should just accept all costs. To help you achieve this, here are nine practical tips to help you reduce your business banking charges.