Top Notch Tips About How To Get An Fha Loan

Fha credit requirements for 2024.

How to get an fha loan. Currently, the national loan limit on an fha loan is. Credit score and down payment. Learn the advantages and disadvantages, eligibility criteria, and.

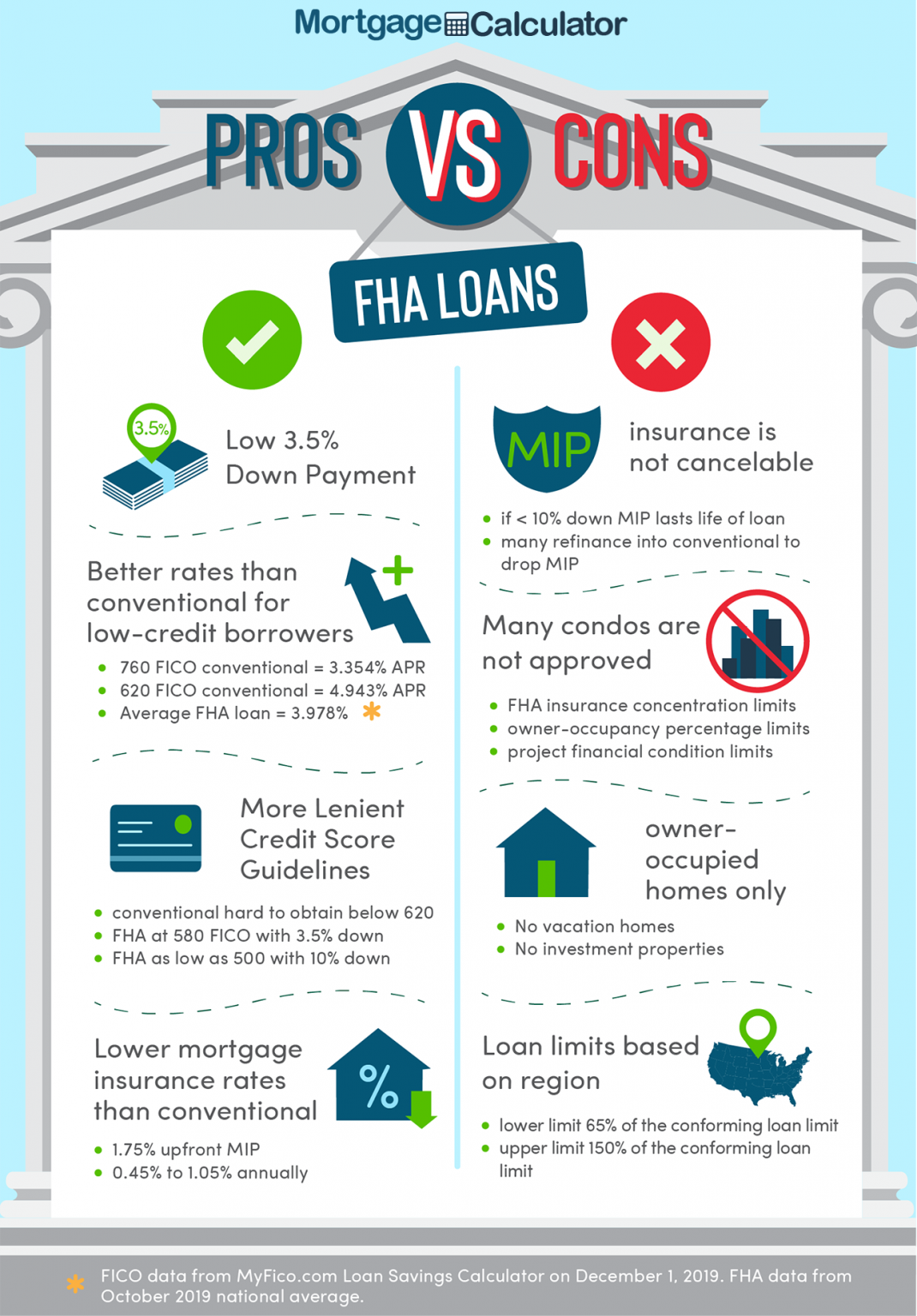

However, you'll need a minimum credit. The basic requirements to qualify for an fha mortgage include: With an fha loan, you can get away with putting down as little as 3.5% on a home purchase.

For example, both oportun and upstart offer loans to borrowers with no credit. Many types of mortgage lenders , including banks and. You need a minimum down.

Look at an fha loan. Because fha loans are backed by a government agency, they're usually easier to qualify for than conventional loans. The monthly cost of property taxes, hoa dues and.

The fha doesn’t make loans directly; You might even be able to get an fha loan with a bankruptcy or other financial issue on your record. Depending on how much you want to borrow and where the property is located, an fha loan may not be right for you.

These include usda, fha, and conventional loans. How do you qualify for an fha loan? They have low down payments, low closing costs, and easy credit.

Homebuyers pay an upfront fha mortgage insurance premium (mip), currently 1.75% of the base loan amount, and an annual mip that is included in your monthly. Fha loans are mortgages that are insured by the federal housing administration (fha), part of hud. If your credit score is between 500 and 579, you’ll need a.

Department of housing and urban. How to get an fha loan: Verify your fha loan eligibility.

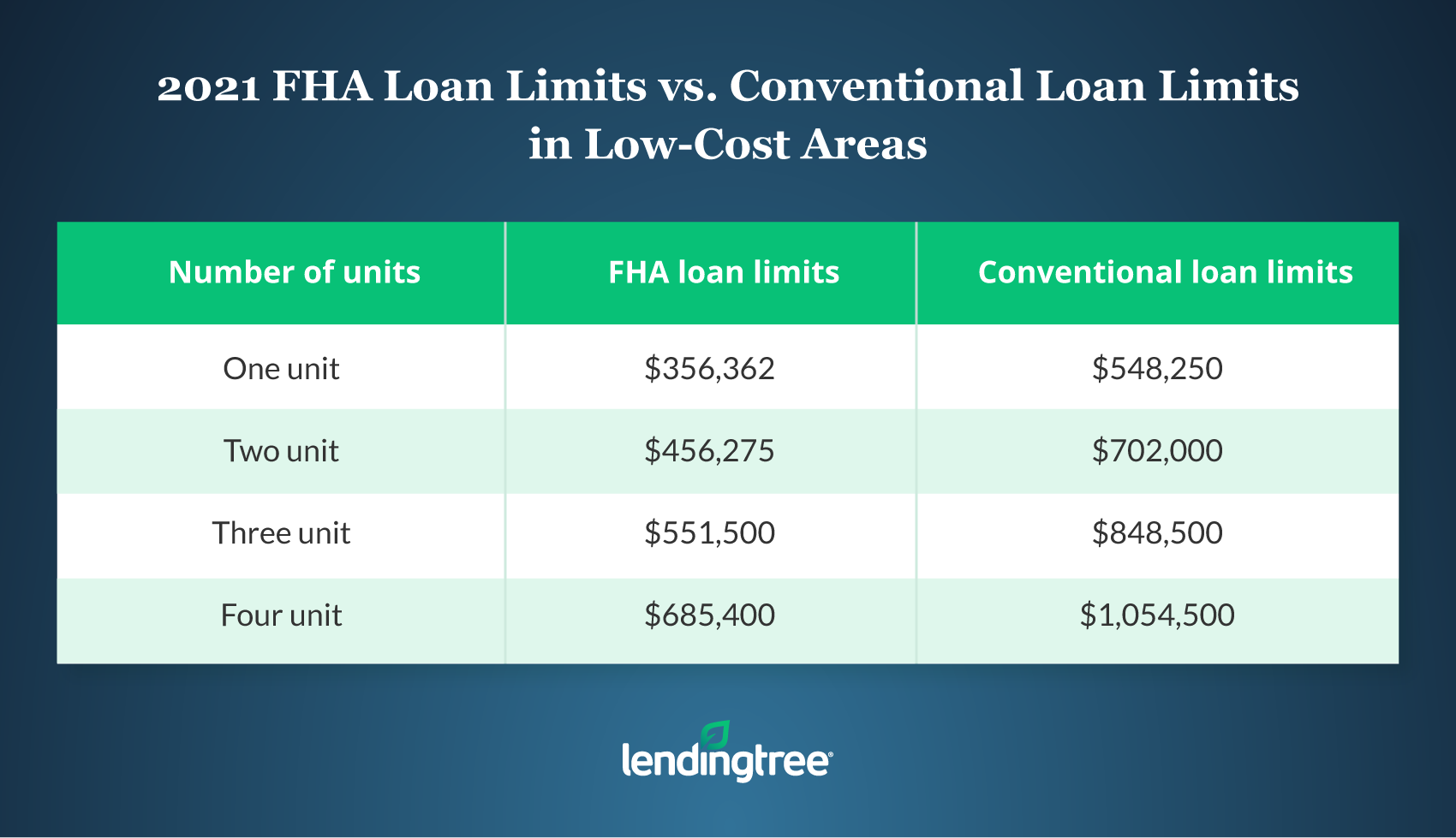

An fha loan is a mortgage loan that is insured by the federal housing administration (fha). Fha loans have limits that dictate how much you can borrow depending on the type of property you’re financing and where. Compared to conventional mortgages, fha loans can be easier to qualify for and allow for borrowers with lower credit scores.

An fha loan is a type of mortgage insured by the federal housing administration (fha), which is overseen by the u.s. Upstart also sometimes provides the option to secure your loan with a vehicle if you. You may qualify for an fha loan if you have debt or a lower credit score.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)