Heartwarming Tips About How To Decrease Credit Card Apr

Key takeaways customers can negotiate with credit card companies for lower interest rates.

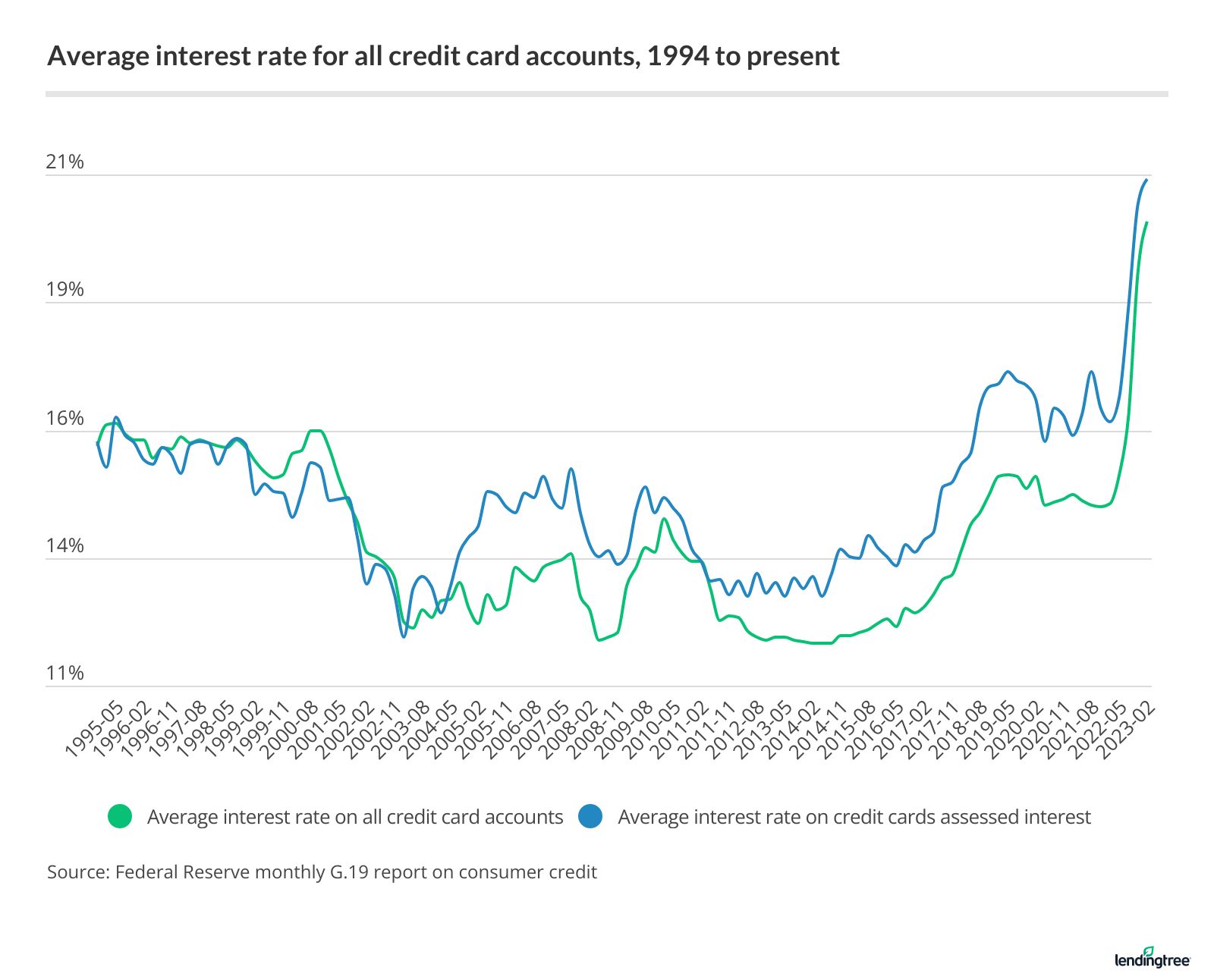

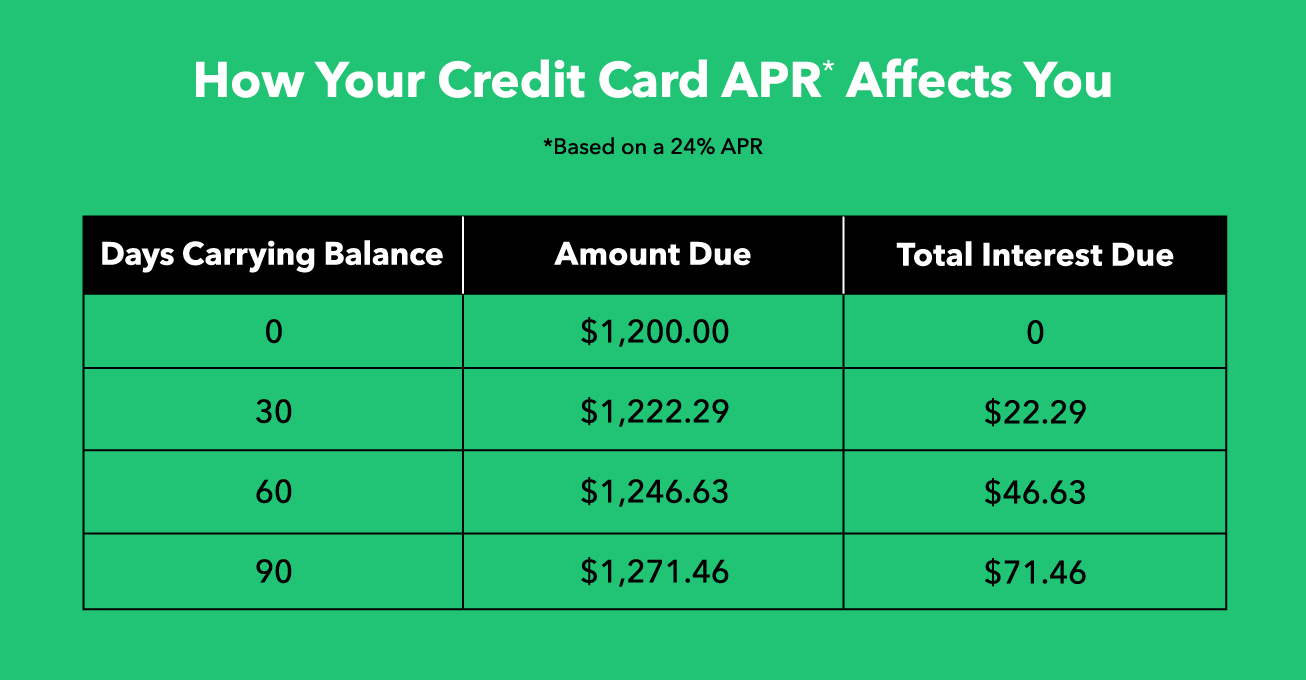

How to decrease credit card apr. Quick facts and stats the average apr for new credit card offers was 20.93% as of q3 2023 and was relatively flat over the previous 6 months. You need to call them and ask them to lower your apr! Contact your credit card company.

How can i lower my credit card apr? Typically, a lower credit utilization ratio leads to a better credit score. Key takeaways your credit card apr can go up if the prime rate changes, you paid your credit card bill late, your intro apr offer ended or your credit score.

Here are some tips on how you can lower your credit card apr: You can lower this ratio by paying off debt or increasing your credit limits. Once you’ve checked your credit reports and you’re ready to negotiate, reach out to.

This number reflects a factor of the amount you pay on your outstanding debt each billing. Collect different card offers if you are among the millions who receive 0% credit card offers in their mailbox, be thankful. Even if you’re not interested in any of.

How to lower your credit card interest rate evaluate your current situation. Here are four steps that can help you secure a lower interest rate on a credit card you already have. 26, 2023, at 2:55 a.m.

And while there’s no industry standard for what’s considered to be a good. Since lending money can be a risky business, the best interest rates are typically reserved. An improvement in your credit score is critical.

Key points the annual percentage rate (apr) is your credit card's interest rate, expressed as a yearly rate. So take steps to get your credit card company to lower your apr. High credit aprs are a pain.

Contact your credit card issuer using. Some credit card issuers allow you to request apr. Getty images | istockphoto knowing the credit card apr types can help you better.

| edited by colin hogan | reviewed by mark evitt | oct. How to get a lower apr on your credit card check your credit reports. 3% apr reduction on purchases chase:

Your credit card company won't lower your apr just because you've been taking care of your credit; Seeking to negotiate a credit card rate can be a good solution in a. They make it difficult to pay off your card in full.

![Average Credit Card Interest Rates & APR Stats [2022]](https://upgradedpoints.com/wp-content/uploads/2021/11/APR-Ranges-and-Averages-for-Credit-Cards-732x791.png)

![Average Credit Card Interest Rates [Statistics by Issuer, Card Type]](https://upgradedpoints.com/wp-content/uploads/2022/02/Average-Credit-Card-Interest-Rates-by-Issuer.png)

![Average Credit Card Interest Rates & APR Stats [2022]](https://upgradedpoints.com/wp-content/uploads/2021/11/upgradedpoints-creditcardinterestrates-graphic-v1_2-732x572.png)