Casual Info About How To Draw A Personal Budget

Calculate your net income the foundation of an effective budget is your net income.

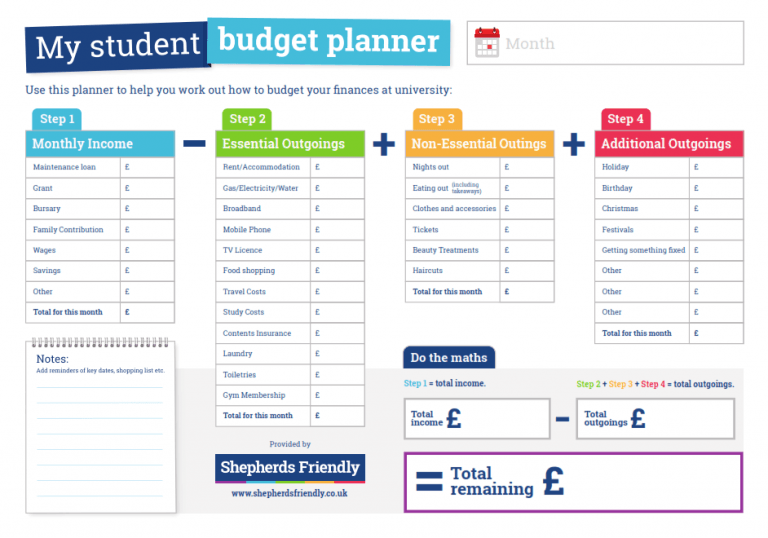

How to draw a personal budget. A successful budget planner helps you decide how to best spend your money while avoiding or reducing debt. The next 30% of your spending goes toward your desires, the things that keep you happy. That means cutting everything you don’t absolutely need—streaming.

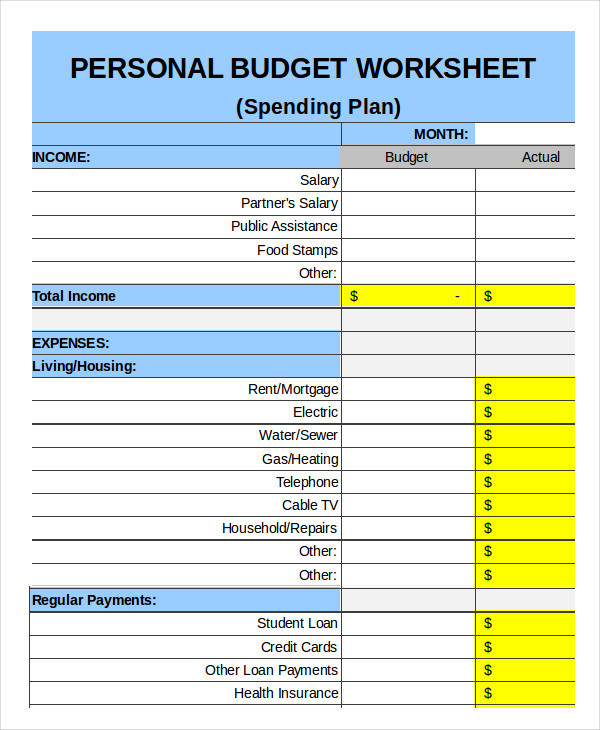

How to make a personal budget in 8 easy steps—plus tips for actually using it step 1: If you're feeling intimidated, you may want to use our monthly budgeting calculator to help you. Use how often you get paid as the timeframe for your budget.

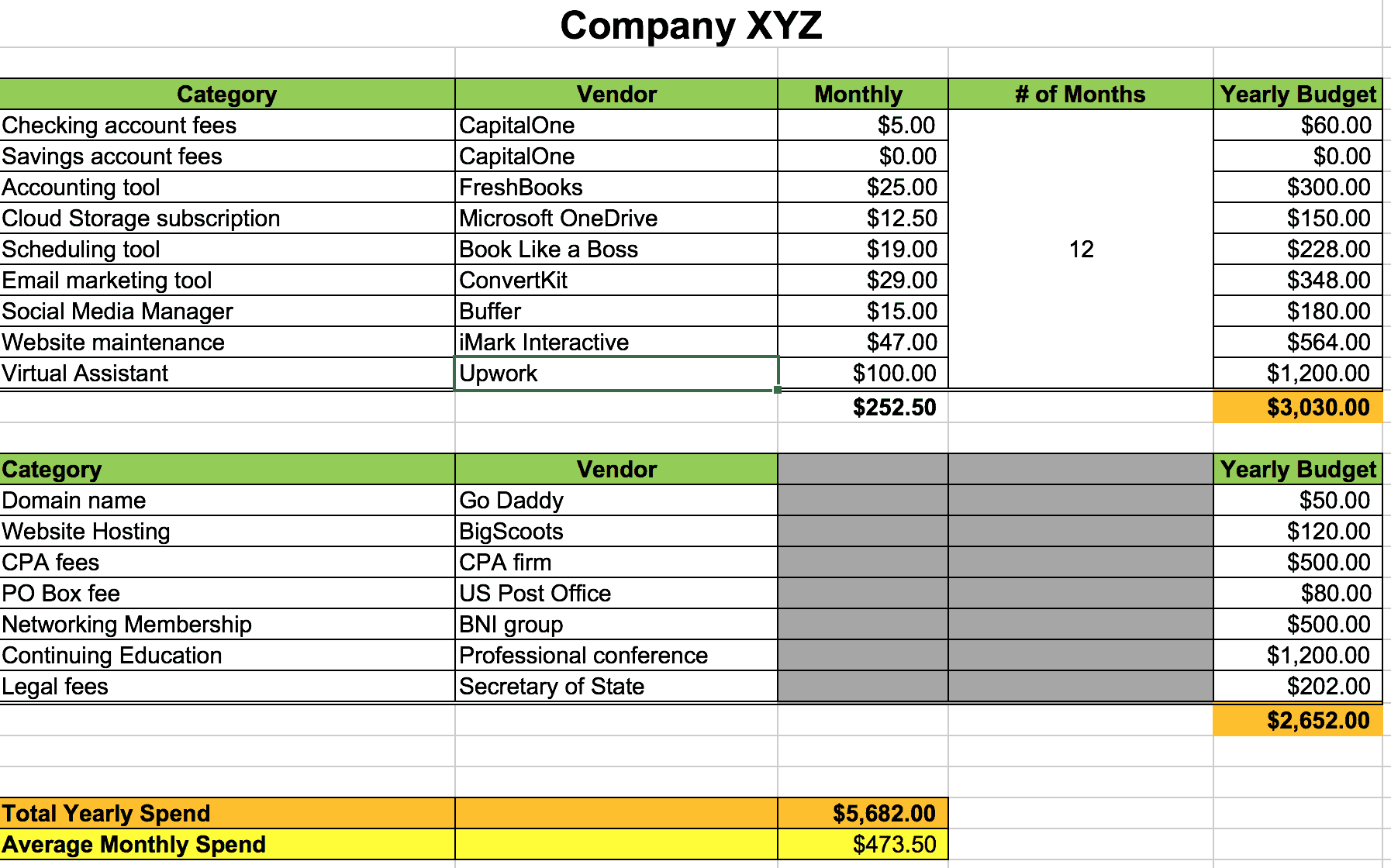

Getting started with making a budget entering your income in your budget entering your expenses in your budget allocating funds for savings and an emergency fund analyzing your budget following up on your budget 1. Calculate the totals for each category to give you an idea of how much you are spending. Learn how to make a budget for the first time in this quick tutorial.

Bills, food, nights out, meals out, family days, birthdays. Commit 20% of your income to savings and debt repayment beyond minimums. For example, if you get paid weekly, set up a weekly budget.

Work to keep the second number lower than the first. This exercise will not only assist you in making an effective budget and helping you to save, making your life a little less hectic and more relaxed, it will also motivate you to trim your expenses so you can achieve your goals and make the. (you go one bite at a time.) and no one leaps into budgeting like a pro.

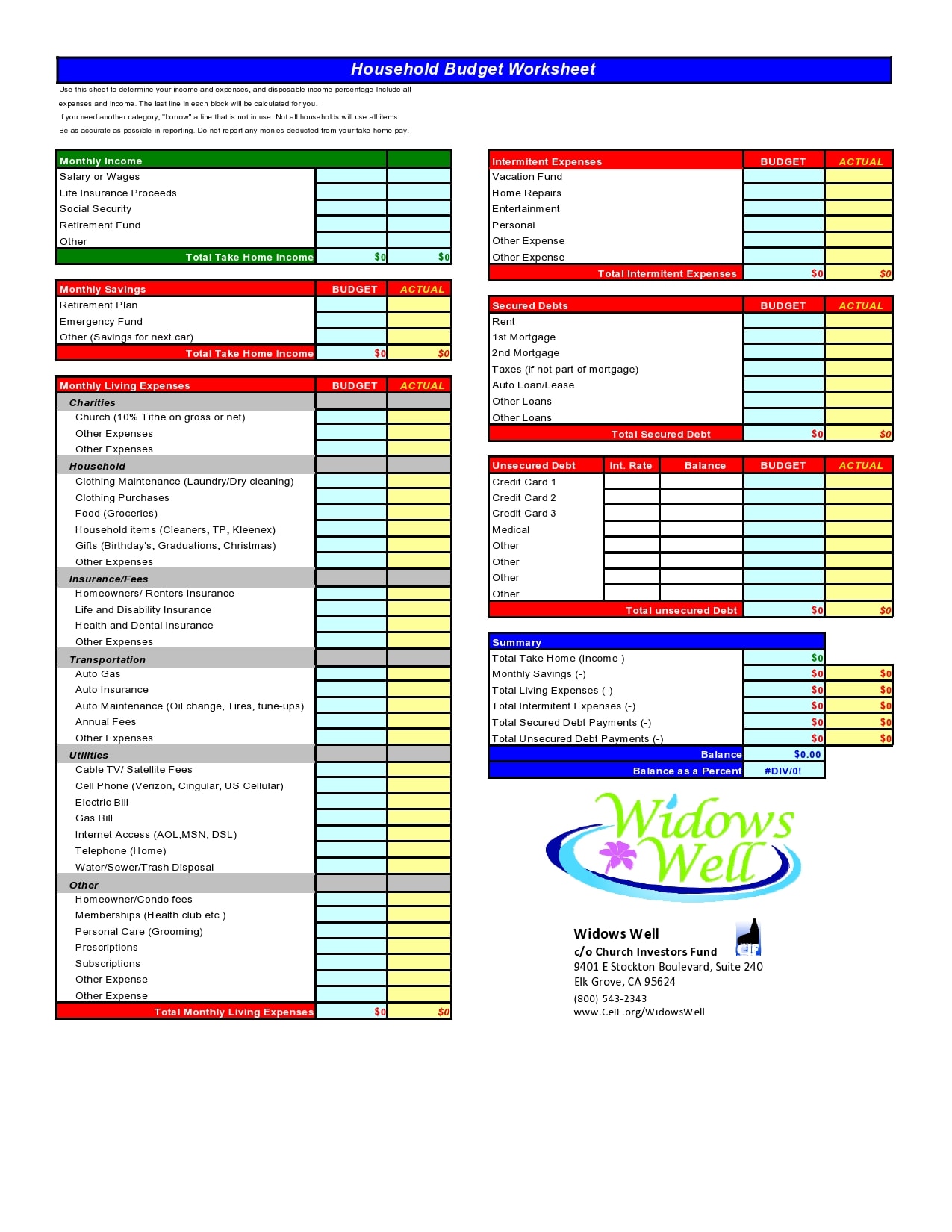

With your income in hard figures, the next step on how to budget is to calculate fixed. Using this rule, you can aim to spend your money in the following fashion: Personal finance financial decisions financial budget personal budget.

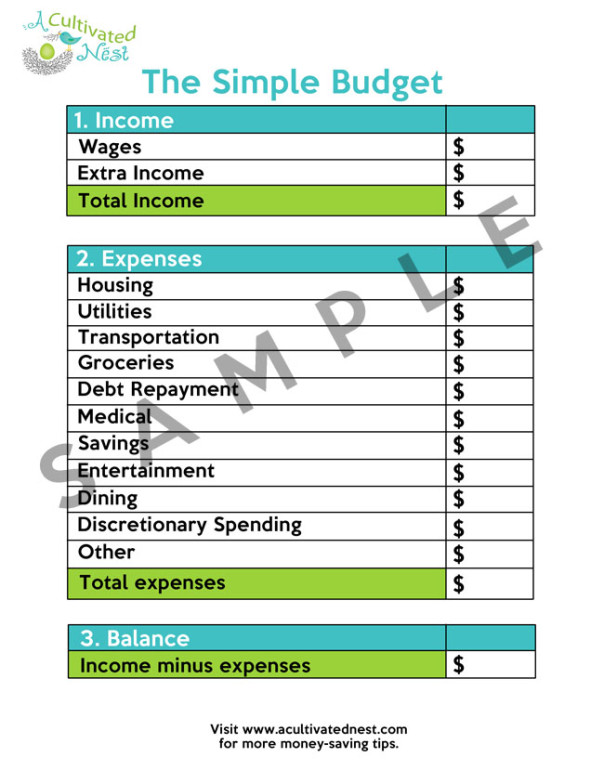

We’ve got three steps to set up that budget and two more to keep it going—each and every month. How to draw up a budget: A budget template (or budget worksheet) is a great way to get everything on paper, right there in front of your eyes.

List all of your fixed expenses. Creating a personal budget is one of the best money moves you can make. The result of this calculation is then compared to costs and expenses, such as property, vehicles, insurance, financial investments, credit instalments, children and sundry household expenses.

Leave 30% of your income for wants. You cannot plan how you’ll spend your future personal income if you don’t know how much you. The budgeting tool takes into account the users basic salary, as well as fringe benefits and other income streams.

Here are the major categories your budget needs, how to setup your income and expenses. The first step of budgeting is determining how much money you make each. Because no one eats an elephant by swallowing it whole.

![Patrice Benoit Art [Download 44+] 36+ Personal Budget Household](https://images.template.net/wp-content/uploads/2016/12/08063346/Household-Financial-Budget-Template.jpg)