Marvelous Info About How To Choose A Benchmark

If you are having trouble picking the best benchmarks software for your pc, our expert guide is here to rescue you.

How to choose a benchmark. You should consider the benchmark's relevance first. Learn what benchmarking is, why it is useful, and how to choose the right competitors to benchmark against in competitive analysis. Below we list the best benchmarks software.

Be the first to add your personal experience 3 how to choose the right benchmarking. Choosing your benchmark by fraser hughes september 2004 (magazine) a benchmark is an index, or a market measurement indicator, that is used to assess the. Pick and choose but how do you choose a benchmark?

The first step in selecting a benchmark model is determining your risk profile. How to use a benchmark to measure the performance of portfolio. A sensible approach is to work with a trusted financial planner to a) identify personal goals (e.g.

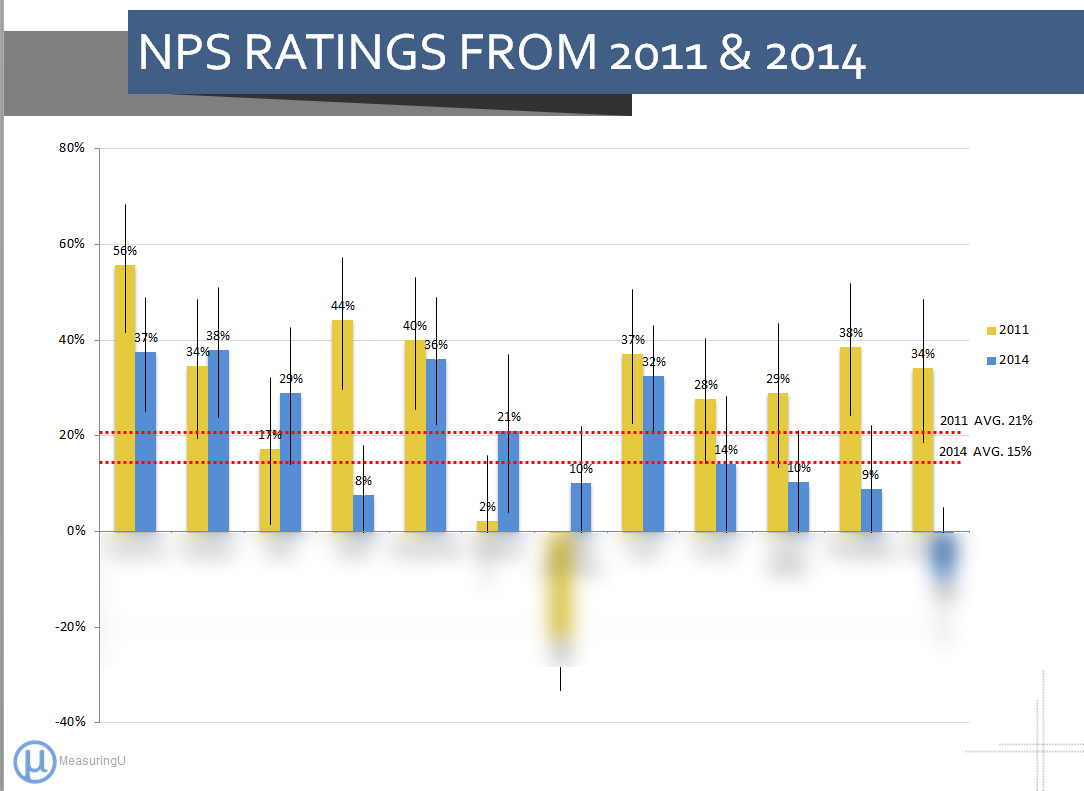

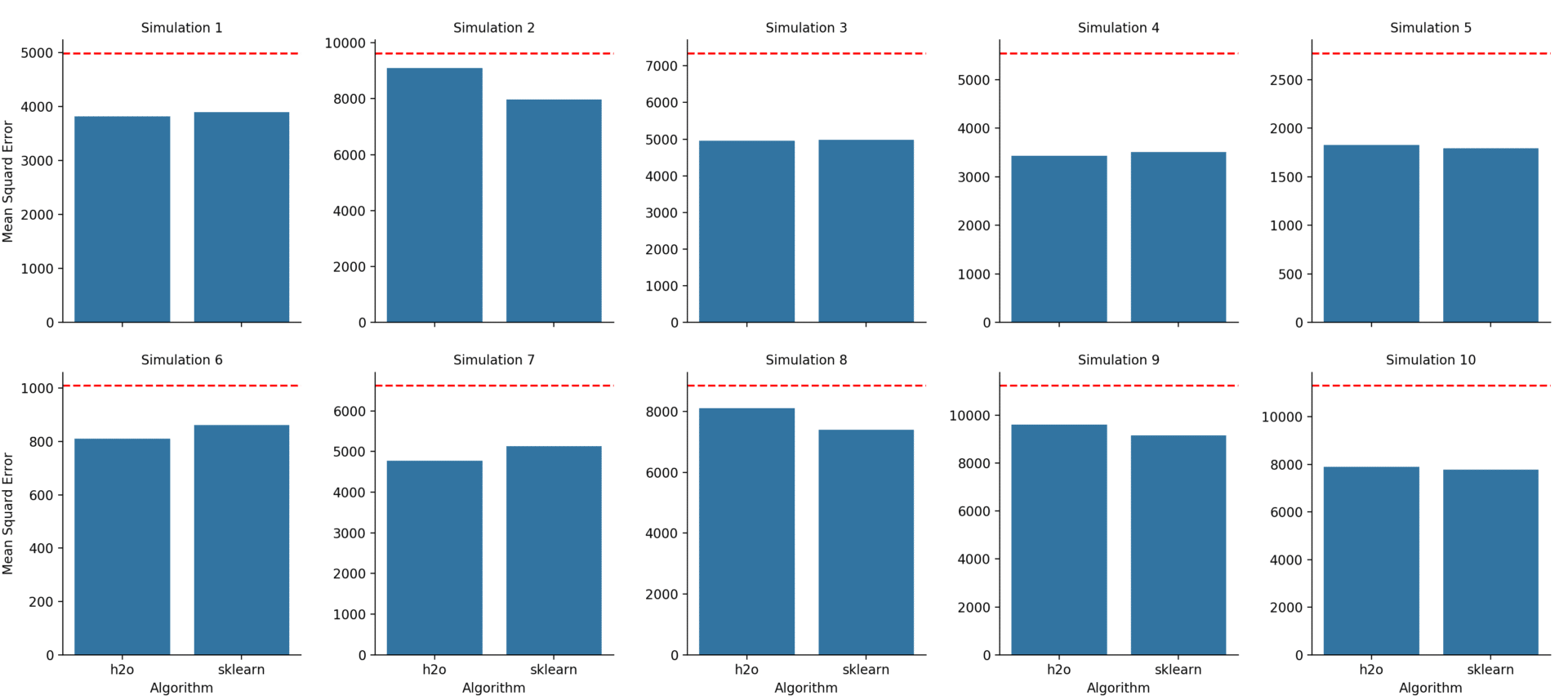

The following are the steps involved when evaluating the performance of a portfolio against a benchmark: There are a variety of things you can set benchmarks against,. 2 why is benchmarking important for strategy?

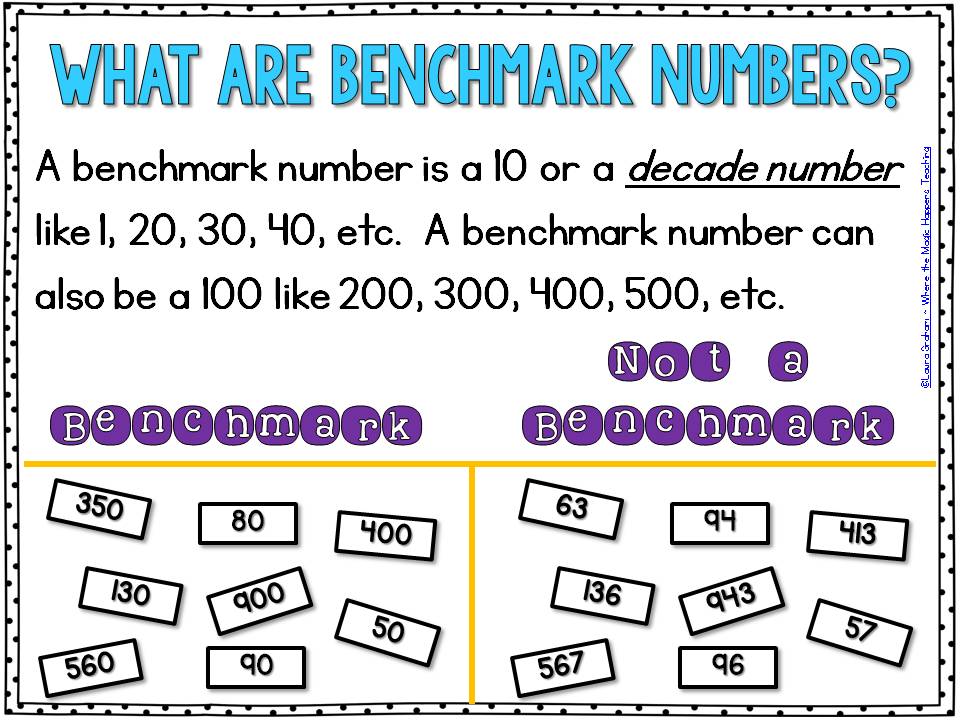

To determine benchmarks, you need to measure your work against something else. A simple benchmark can be any index or etfs or someone’s portfolio. Often a market index, a benchmark typically provides a starting point for a portfolio manager to construct a portfolio and.

Many factors go into determining a risk profile, including your age, how long the funds will be invested, your income, and other financial resources, such as a cash reserve. there are many tools available to help assess your risk. From that menu, select 30. Competitive benchmarking is the process of comparing your company against a number of competitors using a set collection of metrics.

1 what is benchmarking? Userbenchmark is simple, quick, and provides useful information on each component of your system. To set that up, go to file > advanced benchmark.

Powered by ai and the linkedin community 1 define your. These days, the benchmark for many investors and institutions tends to be an index (or. Your custom benchmarks), b) design an investment plan to achieve.

If you're gearing up to ask for a raise, the first step is understanding your current market value. If you’re evaluating your portfolio, make sure you’re using a benchmark that reflects what you’re actually trying to see. How do you know if it is good ornot?

How do you use benchmarking to support your decision making and problem solving processes? A benchmark serves a crucial role in investing.